Strategic Collaborations for Durability: Bagley Risk Management

Strategic Collaborations for Durability: Bagley Risk Management

Blog Article

Exactly How Animals Danger Protection (LRP) Insurance Policy Can Protect Your Livestock Investment

Livestock Threat Defense (LRP) insurance coverage stands as a dependable shield versus the uncertain nature of the market, offering a tactical technique to guarding your assets. By delving into the complexities of LRP insurance coverage and its complex advantages, animals manufacturers can strengthen their investments with a layer of safety and security that goes beyond market changes.

Understanding Animals Risk Protection (LRP) Insurance

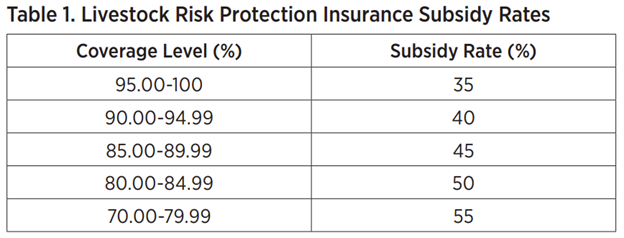

Recognizing Livestock Risk Defense (LRP) Insurance policy is vital for livestock manufacturers aiming to alleviate financial threats linked with cost fluctuations. LRP is a government subsidized insurance coverage product made to secure producers versus a decrease in market value. By providing insurance coverage for market cost declines, LRP aids producers secure a floor rate for their livestock, making certain a minimum degree of profits despite market variations.

One key aspect of LRP is its versatility, allowing producers to personalize insurance coverage degrees and plan lengths to suit their certain requirements. Producers can pick the number of head, weight range, protection cost, and coverage period that line up with their manufacturing goals and take the chance of resistance. Understanding these personalized choices is important for manufacturers to successfully handle their cost threat direct exposure.

Furthermore, LRP is readily available for various livestock kinds, consisting of cattle, swine, and lamb, making it a versatile danger monitoring tool for animals producers across various sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make informed decisions to secure their financial investments and guarantee monetary security despite market uncertainties

Benefits of LRP Insurance Policy for Livestock Producers

Livestock manufacturers leveraging Animals Threat Protection (LRP) Insurance coverage get a strategic advantage in shielding their investments from cost volatility and protecting a secure economic footing in the middle of market unpredictabilities. One key benefit of LRP Insurance coverage is rate security. By setting a flooring on the price of their livestock, manufacturers can reduce the threat of considerable monetary losses in case of market downturns. This enables them to prepare their budget plans extra properly and make notified decisions about their procedures without the consistent concern of cost changes.

In Addition, LRP Insurance offers manufacturers with tranquility of mind. In general, the advantages of LRP Insurance for livestock manufacturers are substantial, providing a useful device for managing danger and ensuring monetary protection in an unforeseeable market environment.

Exactly How LRP Insurance Policy Mitigates Market Risks

Alleviating market risks, Animals Danger Security (LRP) Insurance coverage gives livestock manufacturers with a trusted guard against rate volatility and economic unpredictabilities. By using defense against unforeseen price drops, LRP Insurance helps producers protect their investments and maintain monetary security despite market changes. This type of insurance policy enables animals producers to secure in a price for their pets at the beginning of the plan period, making sure a minimum rate level no matter market changes.

Steps to Safeguard Your Livestock Investment With LRP

In the world of agricultural threat administration, applying Livestock Threat Security (LRP) Insurance policy entails a calculated procedure to protect investments against market fluctuations and unpredictabilities. To protect your livestock investment successfully with LRP, the very first step is to analyze the specific threats your operation encounters, such as price volatility or unforeseen weather condition events. Comprehending these threats allows you to figure out the coverage degree required to secure your financial investment sufficiently. Next off, it is crucial to research study and pick a respectable insurance coverage copyright that supplies LRP plans customized to your livestock and business demands. As soon as you have actually selected a company, very carefully examine the plan terms, problems, and insurance coverage limits to ensure they align with your risk management objectives. In addition, consistently keeping an eye on market patterns and readjusting your coverage as required can help maximize your security against prospective losses. By adhering to these actions vigilantly, you can boost the safety and security of your livestock investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Protection With LRP Insurance Coverage

Making sure enduring monetary security via the utilization of Livestock Danger Defense (LRP) Insurance is a sensible lasting method for farming producers. By integrating LRP Insurance right into their danger management strategies, farmers can safeguard their animals investments against unforeseen market fluctuations and unfavorable events that could More about the author jeopardize their financial well-being over time.

One trick advantage of LRP Insurance policy for lasting monetary safety is the satisfaction it offers. With a trusted insurance plan in position, farmers can minimize the monetary dangers related to unstable market conditions and unforeseen losses because of variables such as condition break outs or natural catastrophes - Bagley Risk Management. This stability permits manufacturers to concentrate on the everyday procedures of their livestock business without consistent bother with possible financial problems

Furthermore, LRP Insurance offers an organized strategy to taking care of threat over the long-term. By establishing certain protection degrees and picking suitable recommendation periods, farmers can tailor their insurance policy prepares to straighten with their monetary objectives and risk resistance, guaranteeing a secure and sustainable future for their livestock operations. To conclude, spending in LRP Insurance coverage is an aggressive technique for farming manufacturers to attain lasting economic safety and safeguard their livelihoods.

Final Thought

To conclude, Animals Danger Protection (LRP) Insurance policy is a useful tool for animals manufacturers to reduce market risks and safeguard their investments. By comprehending the advantages of LRP insurance policy and taking steps to implement it, manufacturers can attain long-lasting monetary safety and security for their operations. LRP insurance coverage gives a safeguard versus price variations and makes certain a level of security in an uncertain market environment. It is a smart selection for safeguarding animals investments.

Report this page